Canadian Inflation Rose More Than Expected in April, But Core Inflation Slowed

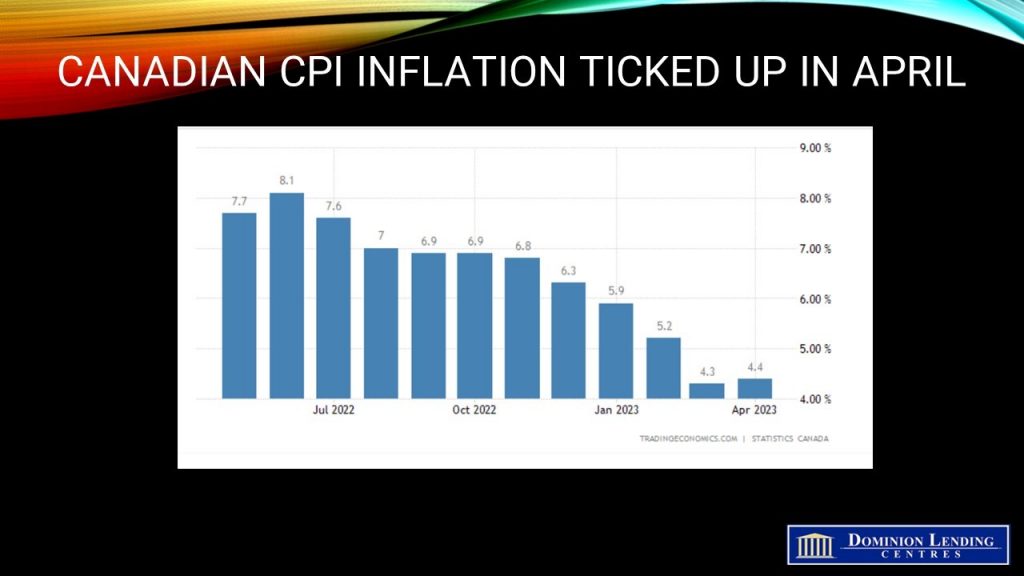

Canadian Inflation Rose More Than Expected in April, But Core Inflation Slowed This sketches an unusual scenario for the Bank of Canada as it approaches its June 7th rate decision. The economy remains resilient, with Canadians grappling with escalated interest rates and continued price pressures. Spring 2023 increasingly looks like the turnaround point for Canada’s housing market after a year-long slump, and labour markets remained firm in April. To be sure, inflation is down significantly from the 8.1% year-on-year peak experienced last June. The initial reduction in inflation was swift and relatively straightforward, but predictably, the following phase is proving to be considerably more challenging. The CPI was up 0.7% in April, following a 0.5% gain in March. Gasoline prices (+6.3%) contributed the most to the headline month-over-month movement. Excluding gasoline, the monthly CPI rose 0.5%. On a seasonally adjusted monthly basis, the CPI rose 0.6%. |

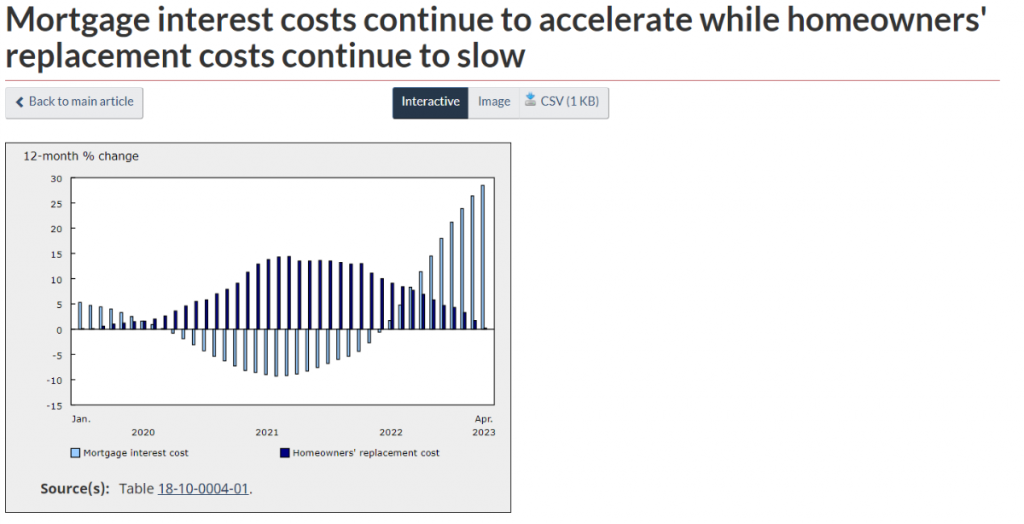

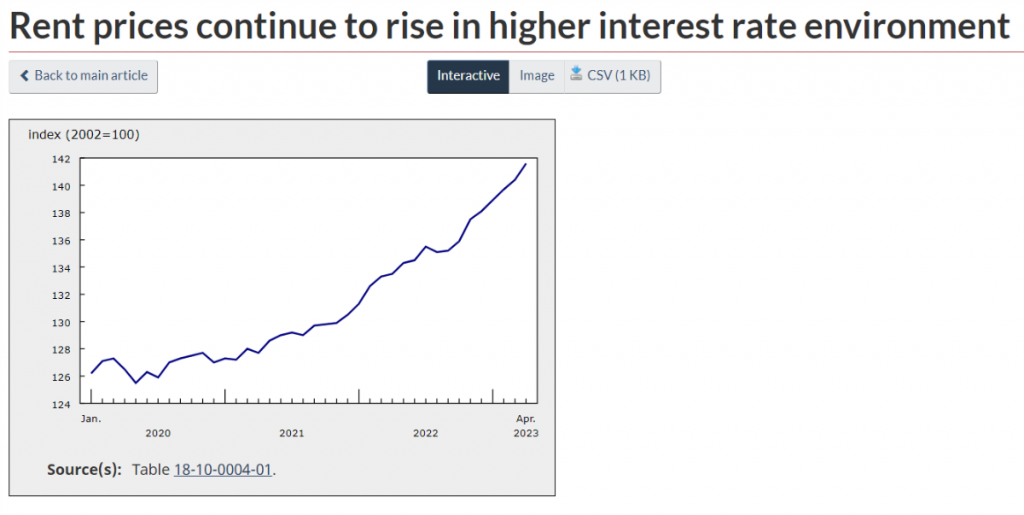

Shelter costs rose 4.9% year-over-year in April after a 5.4% increase in March. Canadians continued to pay more in mortgage interest cost in April (+28.5%) compared with April 2022, as more mortgages were initiated or renewed at higher interest rates. The higher interest rate environment may also contribute to rising rents in April 2023 (+6.1%) by stimulating higher rental demand. The year-over-year increase in the homeowners’ replacement cost index slowed for the 12th consecutive month in April (+0.2%) compared with March (+1.7%), reflecting a general cooling of the housing market.

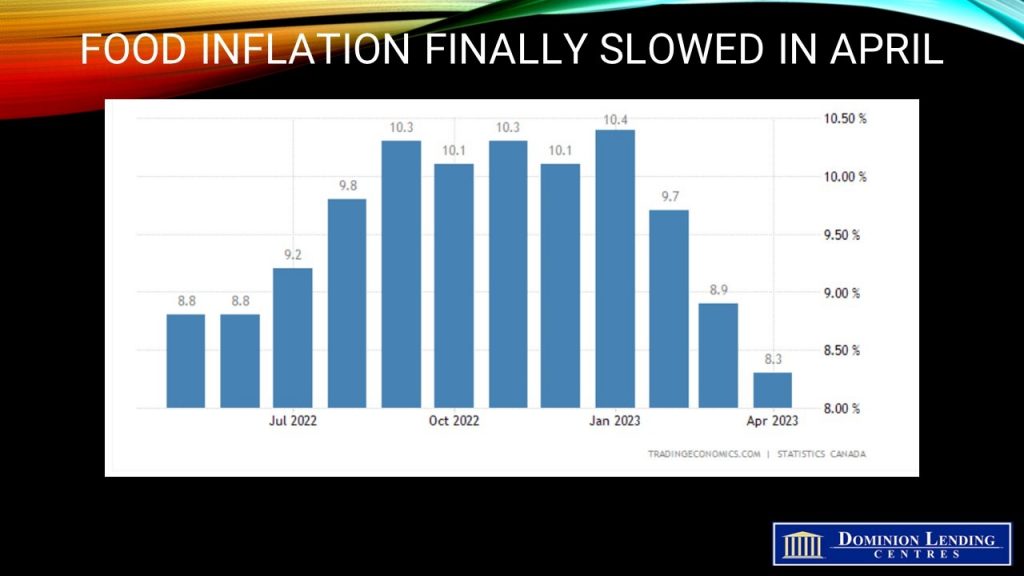

Year over year, prices for groceries rose at a slower rate in April (+9.1%) than in March (+9.7%), with the slowdown stemming from smaller price increases for fresh vegetables and coffee and tea.

Bottom Line

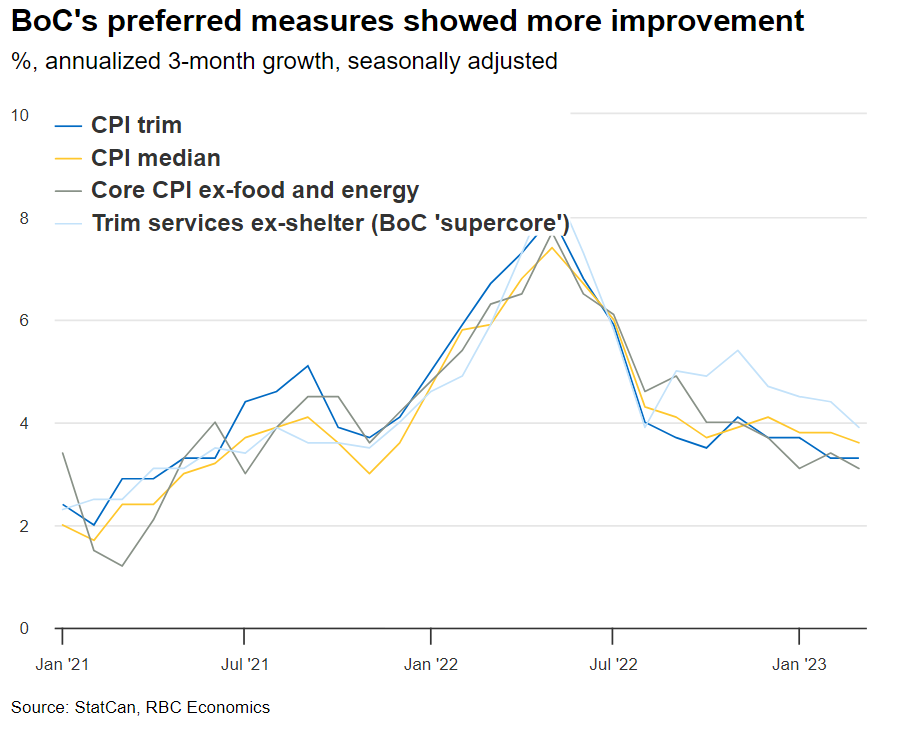

The uptick in April inflation, especially monthly, shows that the road to 2% inflation will be bumpy. Still, the Bank of Canada will be content that their measures of core inflation continue to trend downward (see chart below). The Bank will likely continue the pause in June, but if the May employment numbers continue strong, the Governing Council will indeed warn that they will remain ever vigilant. I do not expect rate cuts this year.