Weaker-Than-Expected July Jobs Report Keeps BoC Rate Cuts In-Play

Canadian employment data, released today by Statistics Canada, showed

a continued slowdown, which historically would have been a harbinger of

recession. This cycle, immigration has augmented the growth of the

labour force and consumer spending, forestalling a significant economic

downturn.

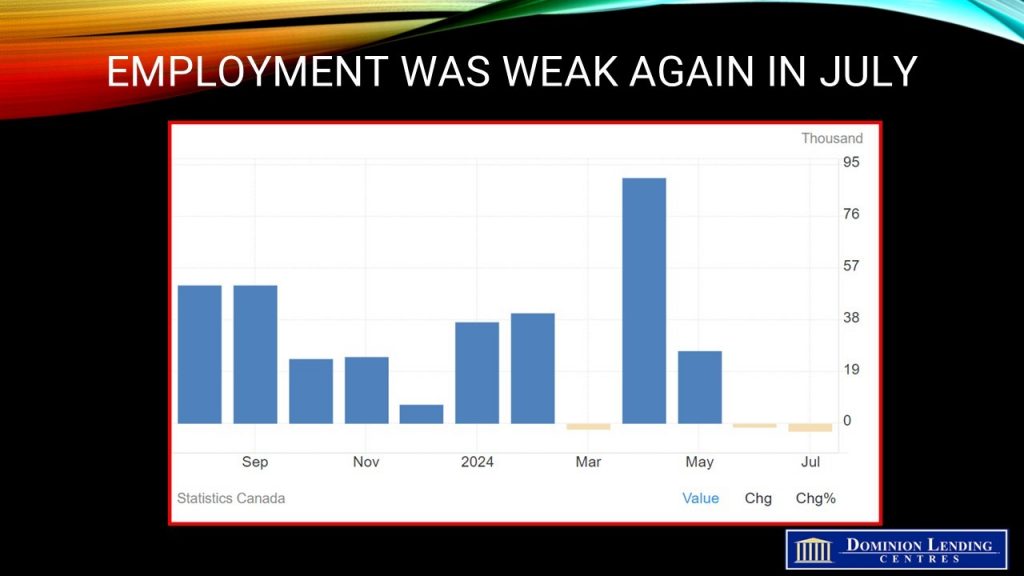

Employment declined again in July, down 2.8K. The

employment rate—the proportion of the population aged 15 and older who

are working—fell 0.2 percentage points to 60.9% in July. The employment

rate has followed a downward trend since reaching a high of 62.4% in

January and February 2023 and has fallen in nine of the last ten months.

In

July 2024, an increase in full-time work (+62,000; +0.4%) was offset by

a decline in part-time work (-64,000; -1.7%). Despite these changes,

part-time employment (+3.4%; +122,000) has grown faster than full-time

employment (+1.4%; +224,000) on a year-over-year basis.

Public sector employment rose by 41,000 (+0.9%) in July and was up

by 205,000 (+4.8%) compared with 12 months earlier. Public sector

employment gains over the last year have been led by increases in health

care and social assistance (+87,000; +6.9%), public administration

(+57,000; +4.8%) and educational services (+33,000; +3.3%) (not

seasonally adjusted).

Self-employment changed little in July and was up by 55,000 (+2.1%) year-over-year.

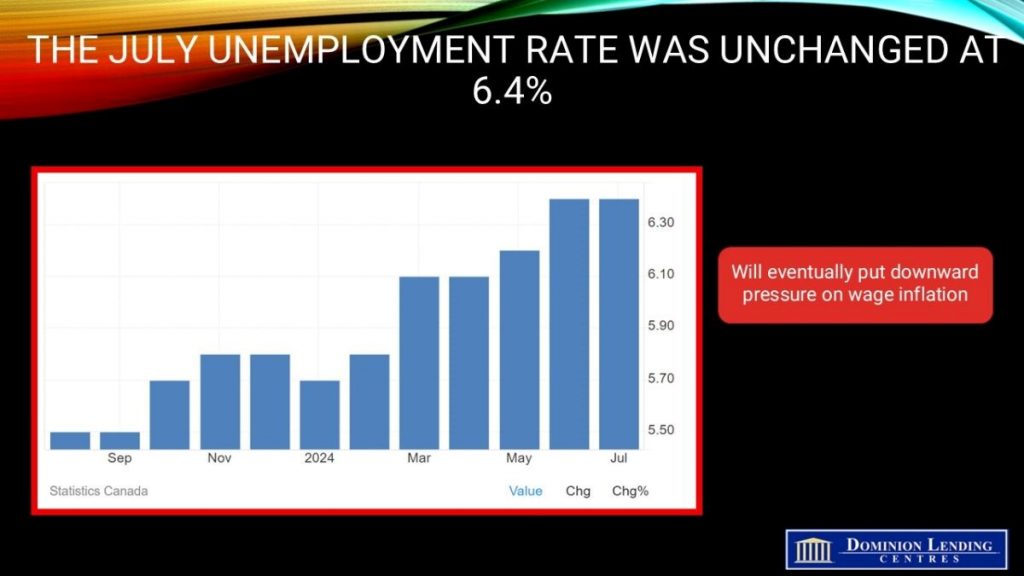

The unemployment rate was unchanged at 6.4% in July, following two

consecutive monthly increases in May (+0.1 percentage points) and June

(+0.2 percentage points). On a year-over-year basis, the unemployment

rate was up by 0.9 percentage points in July.

The jobless rate rose more for recent immigrants, especially youth than those born in Canada.

The unemployment rate for this group was 22.8% in July, up 8.6

percentage points from one year earlier. For recent immigrants in the

core working age group, the unemployment rate rose by 2.0 percentage

points to 10.4% over the same period. In comparison, the unemployment

rate for people born in Canada was up 0.5 percentage points to 5.6% on a

year-over-year basis in July, while the rate for more established

immigrants (who had landed in Canada more than five years earlier) was

up 1.2 percentage points to 6.3%.

In July, employment in wholesale and retail trade decreased by 44,000

(-1.5%), reflecting a continuing downward trend since August 2023. On a

year-over-year basis, employment in the industry was down by 127,000

(-4.2%) in July 2024.

Employment in finance, insurance, real estate, rental, and leasing

declined by 15,000 (-1.0%) in July, marking the first decline since

November 2023. On a year-over-year basis, employment in this industry

showed little change in July 2024.

Public administration saw a rise in employment by 20,000 (+1.6%) in

July, following a decline in June (-8,800; -0.7%). Employment in

transportation and warehousing also increased in July by 15,000 (+1.4%),

partially offsetting declines in May (-21,000; -1.9%) and June

(-12,000; -1.1%).

British Columbia experienced the highest job losses, while Ontario and Saskatchewan were the only provinces to add employment.

Adjusted to US standards, the unemployment rate in Canada for July

was 5.4%, which was 1.1 percentage points higher than in the United

States (4.3%). Compared with 12 months earlier, the unemployment rate

increased by 0.8 percentage points in both Canada and the United States.

The employment rate has decreased in both countries over the past 12

months, with a larger decline in Canada. From July 2023 to July 2024,

the employment rate (adjusted to US concepts) fell by 1.0 percentage

points to 61.5% in Canada, while it declined by 0.4 percentage points to

60.0% in the United States. Compared with 12 months earlier, the

unemployment rate increased by 0.8 percentage points in Canada and the

United States.

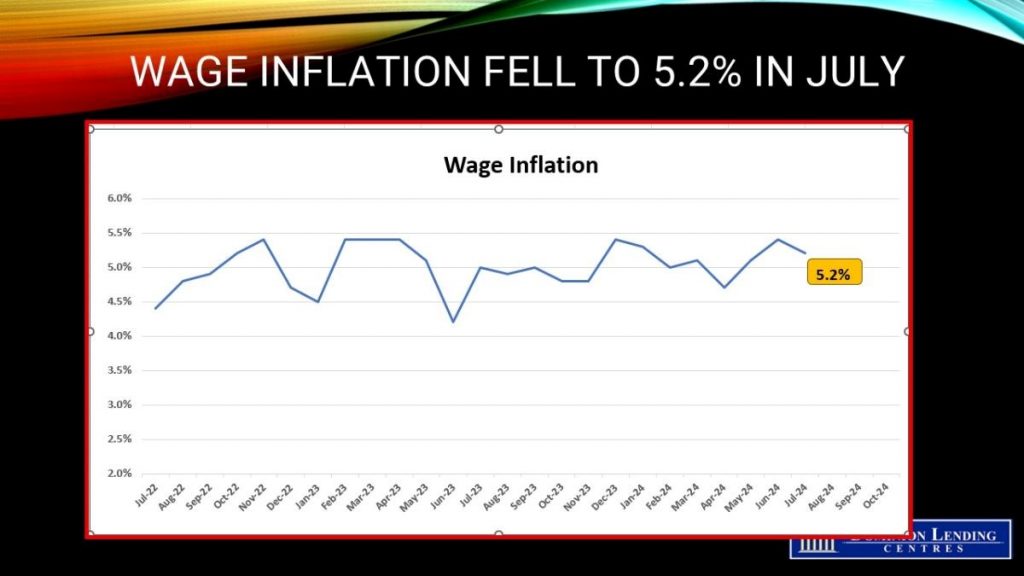

Bottom Line

This is the only jobs report

before the Bank of Canada meets again on September 4. Traders expect

further rate cuts at the three remaining meetings this year.

Last week, weaker employment data in the US contributed to a selloff

in global equities, as bonds rallied amid increased bets that the

Federal Reserve will be forced to cut borrowing costs more deeply and

quickly than previously expected.

The interconnectedness of the economies of the United States and

Canada implies that any further weakening in the former is likely to

permeate into the latter. This scenario affords Macklem the latitude to

normalize borrowing costs without the concern of outpacing the Federal

Reserve to a degree that could jeopardize the Canadian dollar.