Posted on September 8, 2023

AUGUST JOBS REPORT BEAT EXPECTATIONS

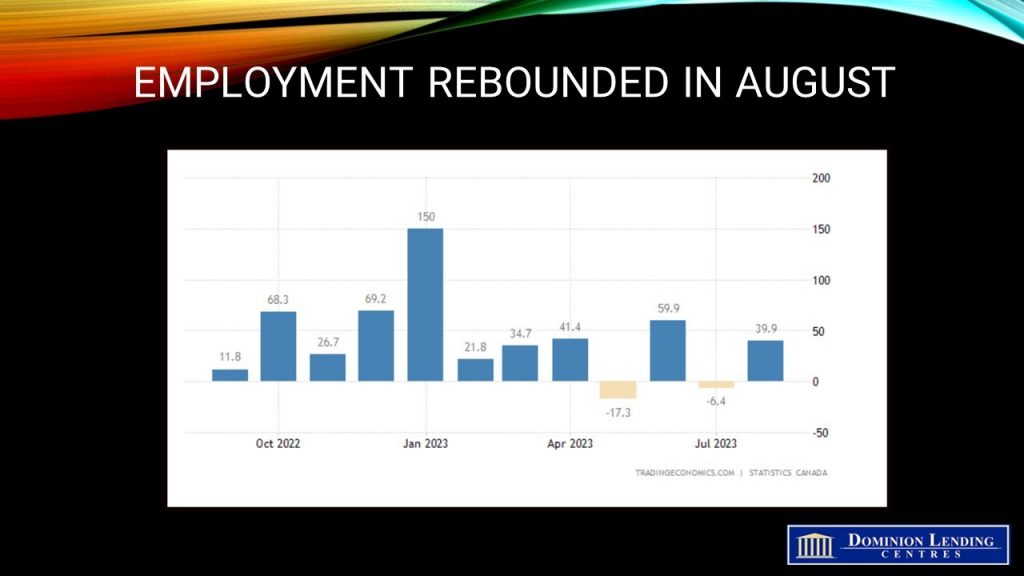

Following a marked decline in employment in July, Statistics Canada reported a gain of 40,000 net new jobs in August. Hiring increased in professional, scientific and technical services and construction and declined in educational services and manufacturing. Population growth outpaced the growth in net new employment, depressing the employment rate to 61.9%.

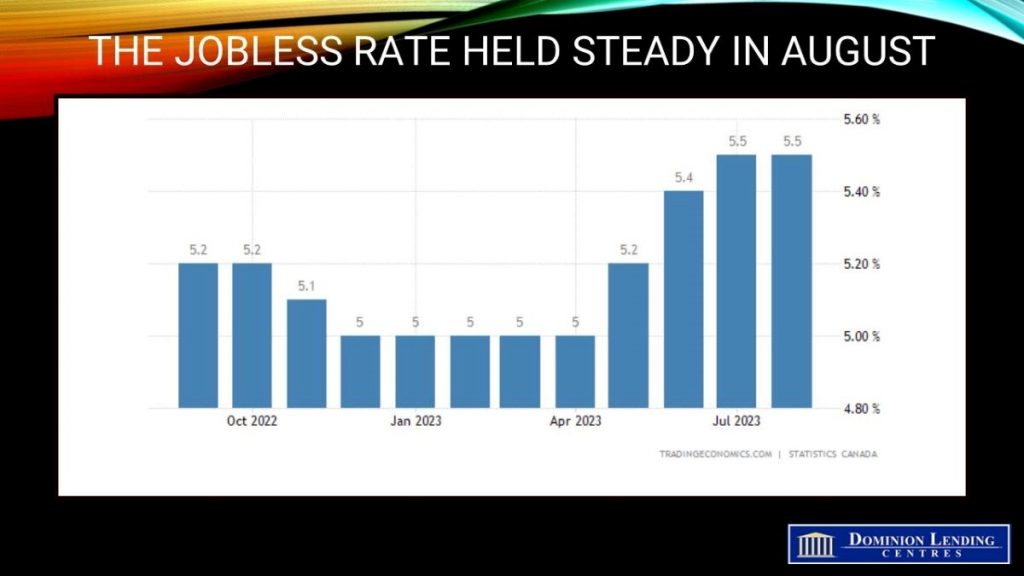

The unemployment rate in Canada was at 5.5% in August, unchanged from the 18-month high from the previous month and slightly below the market estimate of 5.6%. The data consolidated evidence of some softening in the Canadian labour market since the prior year, but the jobless rate remains well below pre-pandemic averages, and the labour market is tight compared to historical levels. Nevertheless, job vacancies are trending downward, and the ratio of unemployment to job vacancies is rising.

Since the beginning of the year, average monthly employment gains are running at about 25,000, while the working age population is growing at 81,000. The surge in immigration warrants a larger than historically normal pace of job growth to maintain any given level of unemployment.

The Bank of Canada paused rate hikes last week saying that excess demand is falling. Today’s employment growth–though stronger than expected–is consistent with that point of view.

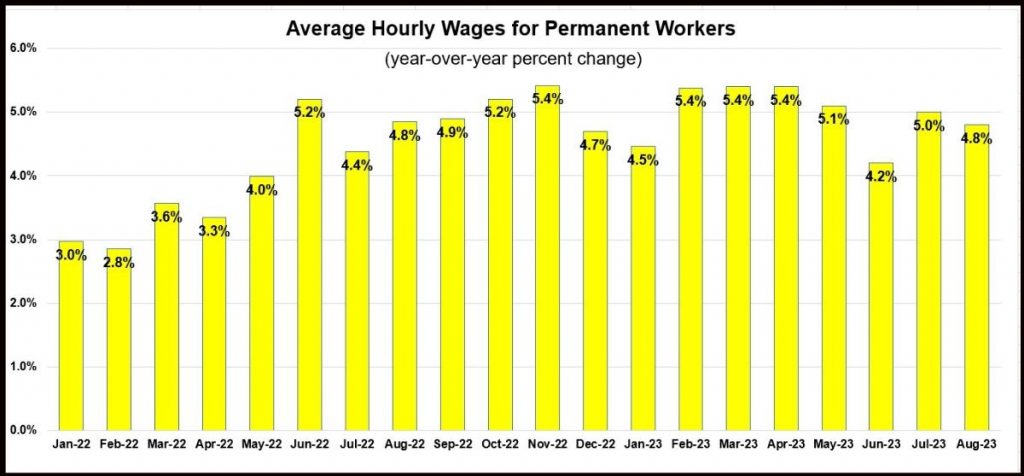

Policymakers will continue to scrutinize incoming economic data to determine if the current interest rates are sufficiently high to return inflation to 2%. They are particularly concerned about substantial wage gains, which perpetuate the wage-price spiralling. Today’s release showed year-over-year wage increases of 4.8%, only slightly below last month’s reading. But with the increasing number of new labour-market entrants, wage pressures are likely to diminish in coming months.

Bottom Line

The next BoC announcement date is October 25. There is another Labour Market Survey and two CPI reports before that date, but anecdotal evidence suggests that the economy is indeed slowing and we are near the end of the monetary tightening rate cycle.